Olive Oil Fraud Study: Is It Safest to Get Your Olive Oil Directly From Producers?

A new research paper on olive oil fraud will be published in the 111th issue of Food Control Journal in May 2020. The research was led by Jing Yan, researcher in Wageningen Food Safety Research.

It evaluates olive oil adulteration risk based on various factors, such as type of business, product type, length of supply chain, geography and cultural factors.

Results were extracted from the assessment of 28 companies throughout the EU.

EVOO is Highly Vulnerable to Fraud

Extra virgin olive oil is filled with healthy fats and natural antioxidants, if extracted carefully and responsibly. Naturally, apart from being very tasty it offers a plethora of health benefits. This is why it has a high market value and attracts fraudulent actions as a result.

Additionally, since olive oil is liquid it can be easily mixed or replaced with inferior olive oil or other vegetable oils.

As a result, it is not uncommon for various studies ( 1, 2 ) to find over 50% of the analyzed olive oils to be either mislabeled or adulterated.

I, myself, have experienced the misery of olive oil adulteration when I was served a “Greek salad with EVOO” in a high quality restaurant in Manhattan, only to find out it was some kind of color-less, scent-less liquid served as EVOO.

It is important for you, the consumer, to have tangible proof that your EVOO supplier is genuine.

Identification vs Prevention

Although great progress has been achieved in identifying olive oil fraud to reduce its financial impact and health hazard, identification does not contribute much to prevention of further incidents.

In 2017, an analytical framework was proposed to establish a situational understanding of the nature of the activities and behaviours involved in fraud throughout the EVOO supply chain.

Recently, various food fraud vulnerability assessment (FFVA) tools have been developed. FFVA tools help companies and regulators evaluate fraud risk in various supply chains.

Prior to this study, factors that lead to fraud in olive oil supply chain remained largely unknown.

Profile of Companies Involved in EVOO Supply Chain

28 companies from the EU, including Greece, Italy, France, Spain, Portugal and the Netherlands were included in the study. Assessment was completed through specialized questionnaires that evaluated perceived fraud risk on a scale of 1 (low) to 3 (high) and where then statistically analyzed to reveal an in depth understanding on olive oil fraud.

Companies typically involved in the EVOO supply chain are of four types;

Olive Oil Producers

Businesses like our family create the olive oil. Most of them are located in the Mediterranean part of the EU (over 70% of worldwide production). Olive oil producers vary by size and business model. Differences are better explained in my article on olive oil pricing. The important difference among producers to remember, is that some, like us, also control the cultivation part, while others do not.

Food Manufacturers

These are companies that buy olive oil to add it as an ingredient to other products they make, such as pastry, sauces, crackers, etc. Although these companies were perceived as the least vulnerable ones to olive oil fraud, they are irrelevant to olive oil as an end product, so they are not going to be thoroughly mentioned in this briefing.

Business to Business (B2B)

This type of business typically buys olive oil from the producer and sells it to retailers so they can finally sell it to you, the end consumer. B2B companies benefit from the need for mass consumption, large cities, local networking and great distances.

Retailers

They are businesses that sell olive oil directly to consumers. Types vary from hyper markets to neighborhood delicatessens. EVOO price and quality usually vary depending on the type of retailer. Some small retailers, especially some within the EU, choose to directly get supplied with EVOO from olive oil producers.

Olive Oil Fraud Factors

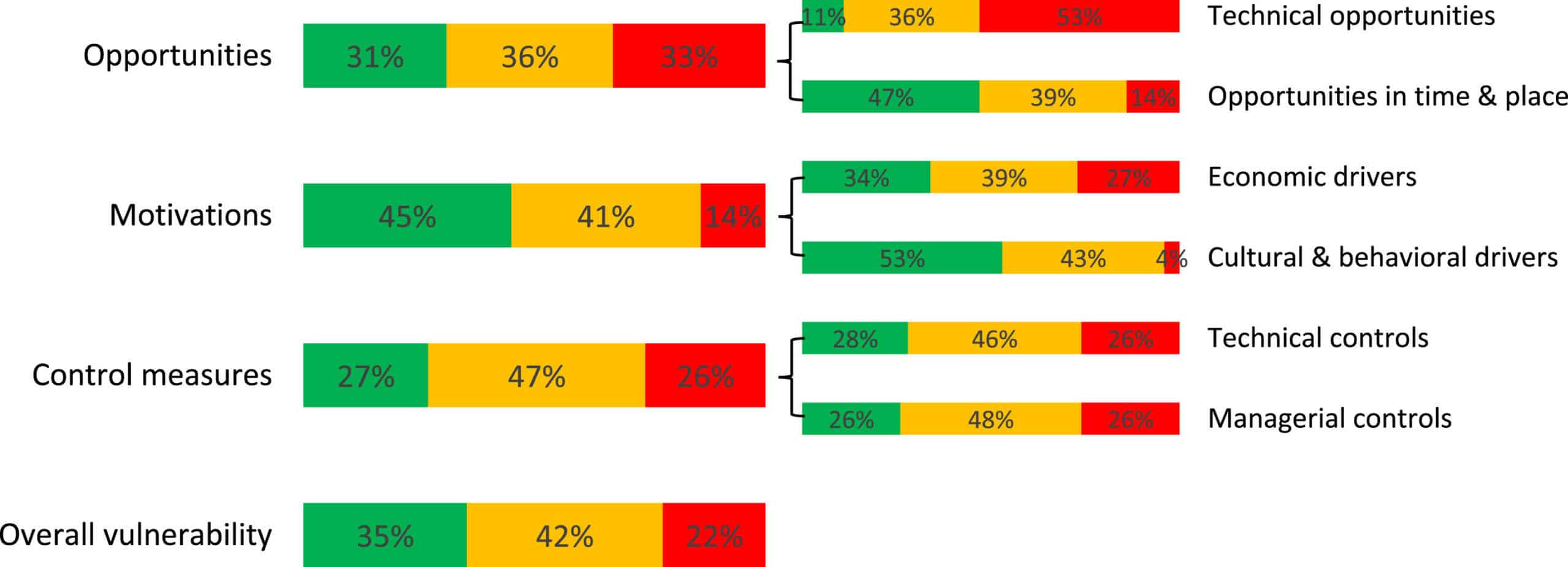

Factors that contribute to EVOO Fraud are grouped as: – Motivations – Opportunities – Lack of Preventive Measures Vulnerability has been evaluated as high (red) especially in regards to technical opportunities and lack of control measures. Only 35% of all questions were rated low vulnerability, which indicates a largely problematic supply chain model.Technical Opportunities for EVOO Fraud

The technical factors summed a medium – high vulnerability score of more than 80%. These factors are: It is simple to handle EVOO. It is easy to adulterate extra virgin olive oil: This supports the fact that liquid adulteration with another liquid is common and physically the easiest to perform. The detection and confirmation of the EVOO fraud are difficult and require advanced laboratory analysis.Economic Drivers for EVOO Fraud

Another factor that drives extra virgin olive oil fraud is extreme, multi-level competition which gives rise to extreme pressure in regards to olive oil pricing. Normally, the solution would be for businesses under pressure to understand the typical features of their olive oil and establish a strong marketing strategy to promote them as unique and distinctive traits of the product to gain market share. Unfortunately, fraudsters are driven more towards illegal actions, aided by the lack of measures and technical difficulty of identifying adulteration. As a result, economic drivers ignite a medium – high vulnerability score of 66%.Control Measures

80% of Retailers and B2B companies and 60% of Olive Oil Producers stated that they predominantly lack technical controls. 87% of B2B companies were perceived to be more vulnerable to olive oil fraud due to lack of managerial controls. Olive oil producers (green = 37%) have more adequate control measures in place, followed by the retailers (green = 17%) and the B2B companies (green = 13%) Similar to other supply chain models, the companies in the middle and end of the supply chain (B2B companies and retailers) are more vulnerable to fraud than the companies at the beginning of the supply chain (producers).

Editor: Athanasios Demeslis

FOUNDER OF MYROLION

The article was studied and summarized by Athanasios so that our family’s friends can increase their understanding on factors that affect olive oil fraud.

Read more on olive oil.

Get our family’s High Phenolic, Organic, Extra Virgin Olive Oil.